How To Speed Up Invoice Payments As A Trades Business

If there is one thing guaranteed to keep any small business owner awake at night, it’s cash flow.

According to research data, the average small business in the UK (those with less than £1 million turnover), waits an average of 71 days to get paid.

This trend for late payments is expected to cost the UK economy a massive £2.5bn a year and takes a huge toll on small business owners.

The Federation of Small Businesses says that small business owners waste an incredible 1.2 days per month simply chasing late invoice payments. Time that they could be spent quoting for a new job or even taking your business digital.

What’s worse, late payments cost 50,000 small businesses their livelihood each year.

As a trades worker, you’ve most likely spent more than your fair share of time chasing up invoice payments.

Not only is this a waste of your time and a burden on cash flow, but it could also risk your ability to pay your staff and your suppliers on time.

It’s not just the bottom line that you have to worry about either.

Not having a system in place to collect payments efficiently when a job is done could also impact on your ability to run your trades business. Putting both your company and your staff’s roles at risk.

The Guardian reports that,

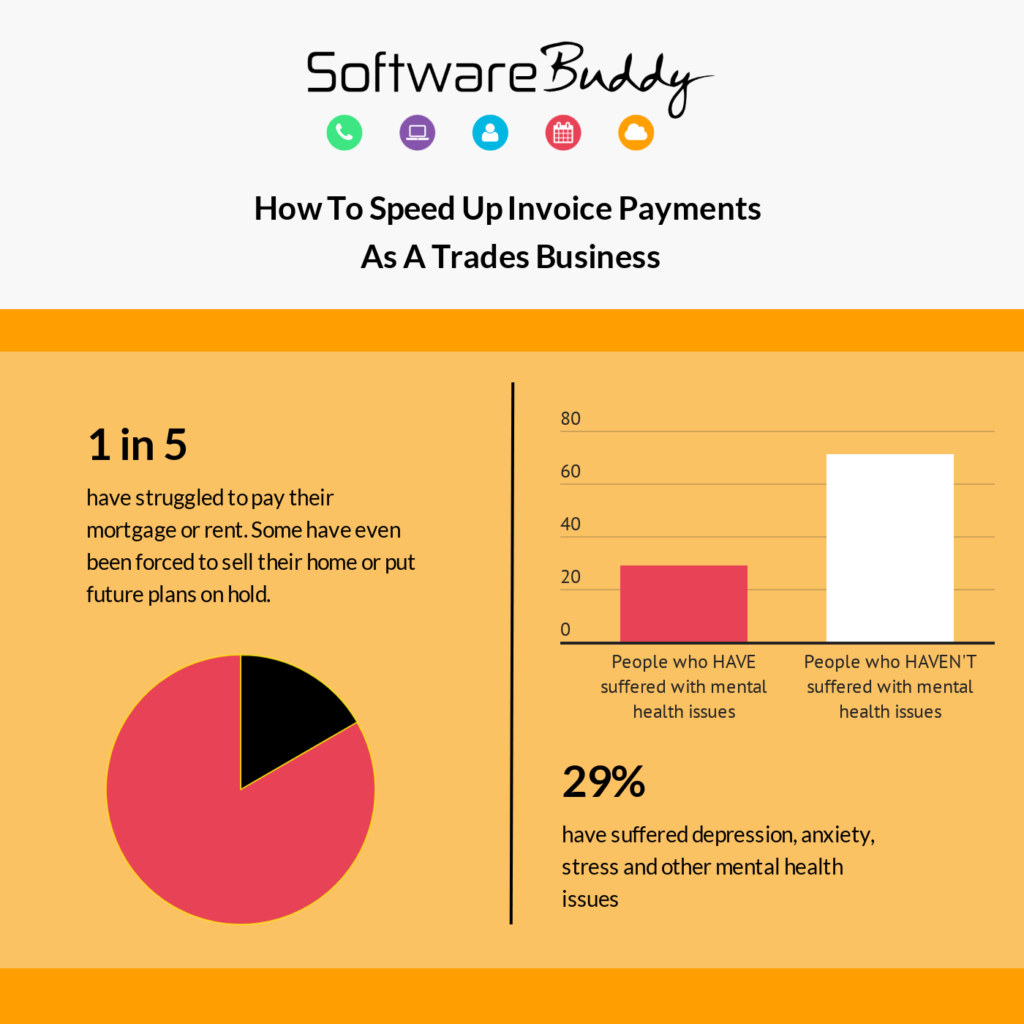

“…research commissioned by the Prompt Payment Directory(PPD) has found late payments are affecting entrepreneurs personally as well as professionally.

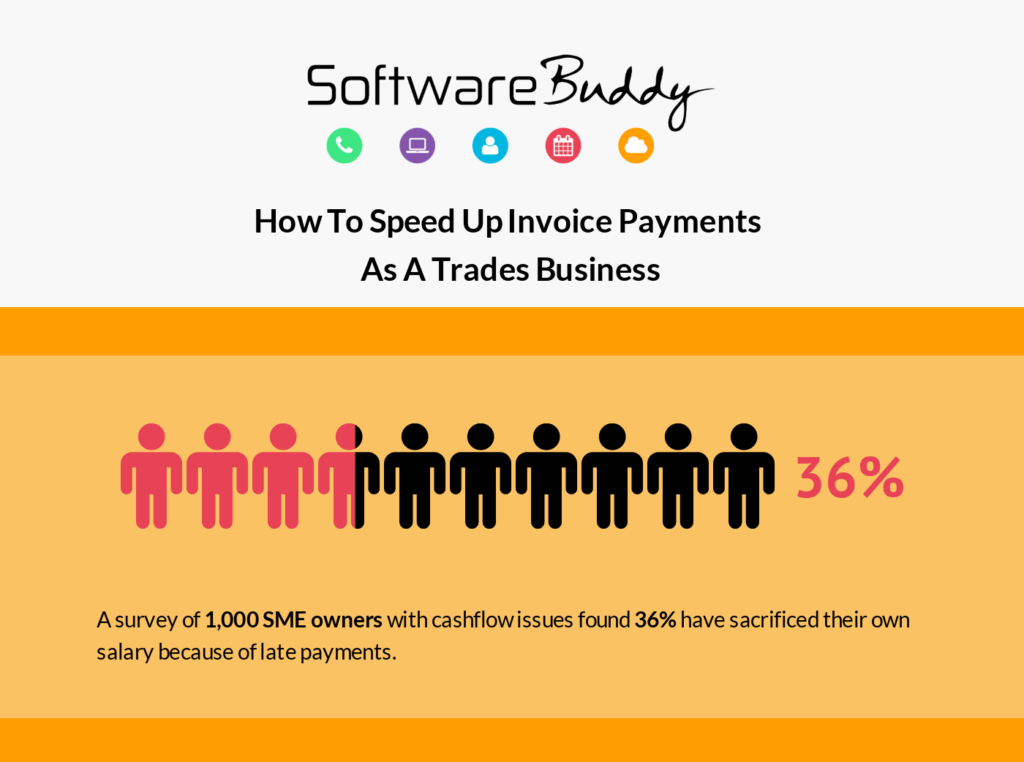

A survey of 1,000 SME owners with cashflow issues found more than a third (36%) have sacrificed their own salary because of late payments. 29% have suffered depression, anxiety, stress and other mental health issues, and one in five (21%) have struggled to pay their mortgage or rent.

Some have even been forced to sell their home or put future plans on hold.”

The good news is that there are measures you can take to reduce the 71-day payment window and get paid much sooner. Perhaps even with a deposit or pre-payment when a quote is agreed or there and then when a job is completed.

This is provided, of course, you select the right jobbing software app for your trades business.

Electronic Payments

The age of cash payments and waiting around for a bank transfer to turn up is declining. Whilst these more traditional methods still exist, the digital age is making it possible for electronic payments to be taken even more quickly.

Most job management apps now have inbuilt links to card processors such as Stripe or Square.

These act like traditional credit card payment processing services like WorldPay but they are free to sign up. Don’t charge a monthly fee and only charge a commission when you use the system.

Unsure if this will work?

Consider this; when you order something from Amazon, you don’t think twice about paying at checkout.

When you order your monthly shop from Tesco or Sainsbury’s online, you expect to pay when you place your order.

Payment culture is changing, and you can use this to speed up your payment process in your trades business too.

Offsetting Processing Cost With The Cost Of Late Payment

Just as you might have weighed up the initial cost of buying an iPad to run job management software versus sticking with paper, it’s well worth looking at the numbers for electronic payment processing.

On one hand, you will have to pay a minor transaction fee to use the system. But the advantage is, that you get paid right away, on-site when a job is done.

The cost of that card fee can be easily justified when you consider the time and resources that you would normally spend chasing overdue payments.

As we have seen, chasing overdue invoices takes about a day and a couple of hours of your time each month.

A £500 job that is paid through a credit card app costs around £7.20 in fees. That’s the equivalent of one hour’s worth of work at minimum wage.

If that still seems like too high a price to pay, why not review your pricing to factor in that card payment cost?