What’s Right For You

Ask any successful tradesmen about pricing strategies and they’ll all tell you the same thing: the single most important element of running your own trades business is your bottom line.

Whilst having a clear business strategy is essential and building a great reputation is key – at the end of the day, it all comes down to turnover.

Yet we all know that keeping tabs on the financial side of your trades business is one of the biggest challenges you face as a business owner.

If you are new to running a trades business, you can easily become overwhelmed from balancing;

- The pricing structure

- The quotes

- The invoicing

- Chasing payments

- Maintaining healthy cash flow

…it’s easy to see how things can get complicated, fast.

Even if you have been running your business for years, adapting to new technologies or legislation can get tricky.

There are so many different systems out there, each with a variety of features and services. How do you choose the software that’s right for your business?

Getting Pricing And Payments Right

Choosing the right pricing and payments system for your business could be the difference between success and failure in the trades business.

No matter how great your services are, or how great a reputation you manage to build

- If your quotes are too low

- Your customers are facing complications making payments, or

- Invoices are not being issued on top.

You could quickly see problems with cash flow and, if not sorted, be put you out of business entirely.

ServiceM8 can help you build a pricing structure that works for your business, as well as issuing invoices and receiving payments with ease.

Here’s how it can help you strike the right balance with the financial side of your business.

How To Create A Pricing And Quotes Structure

First thing’s first. Focus on your pricing strategy and the method you want to adopt to quote to your clients.

By setting prices that are too low, you will struggle to make a profit for your business which, in turn, will make it harder for your business to grow and expand.

Likewise, prices that are set too high may put off your potential clients as they look elsewhere and you lose their business.

The Profit Formula

There are lots of different ways you can ensure your pricing is right. One of the best ways is to use a formula. Here’s a simple one:

-

- First, you will need to calculate an hourly rate for yourself and your team. This is the labour cost. You will want to factor in base salary, earnings, targets/bonuses, mandatory and all employer costs such as Employers National Insurance and Pension contributions.

- Next, consider the materials that you’ll need for the job. Plus any mark-up to these materials – after all, you’ll be selecting, ordering and handling those materials as part of the project.

- Add in allocation of business overhead costs, including any additional business running costs.

- Vehicle and fuel costs.

- Marketing for your business, what you will need to spend to acquire your customer base.

- The cost of insurance and equipment for your team.

- Finally, you come to the profit part of the equation. You’re in business to make money, right?

Your quote should be enough to cover all these costs, and still have your desired profit target amount leftover.

Issuing Quotes, Right First Time & OnTime

For your trades business, time is money. The time you spend writing quotes for your customers can quickly eat into your time so you need a system that will help you to quote fast; software that helps you put together job-winning quotes within seconds.

With ServiceM8, you can choose from pre-configured labour rates, and add in standard material costs with just a few clicks or taps.

The job costing feature allows you to estimate the profitability of each job, so you can see exactly what you’ll be earning once costs are factored in.

This intelligent process is essential for a business that wants to get ahead.

Invoicing & Avoiding Late Payments

When a job is complete, you want to get paid – fast.

To be able to do this, you need to make sure that the whole invoicing process works seamlessly, both for you as well as for your clients.

For small businesses all across the UK, receiving late payments is one of the biggest problems.

- Businesses with an annual turnover of less than £1m can wait an average of 72 days for invoices to be paid. That’s a ten-week wait – and it can put a huge strain on your cash flow.

- 1 in 4 insolvencies can be attributed to late payment culture.

- Figures have also shown that 21% of small businesses are currently owed more than £25,000 in late payments. One in ten are owed more than £100,000!

ServiceM8 Solutions To Late Payments

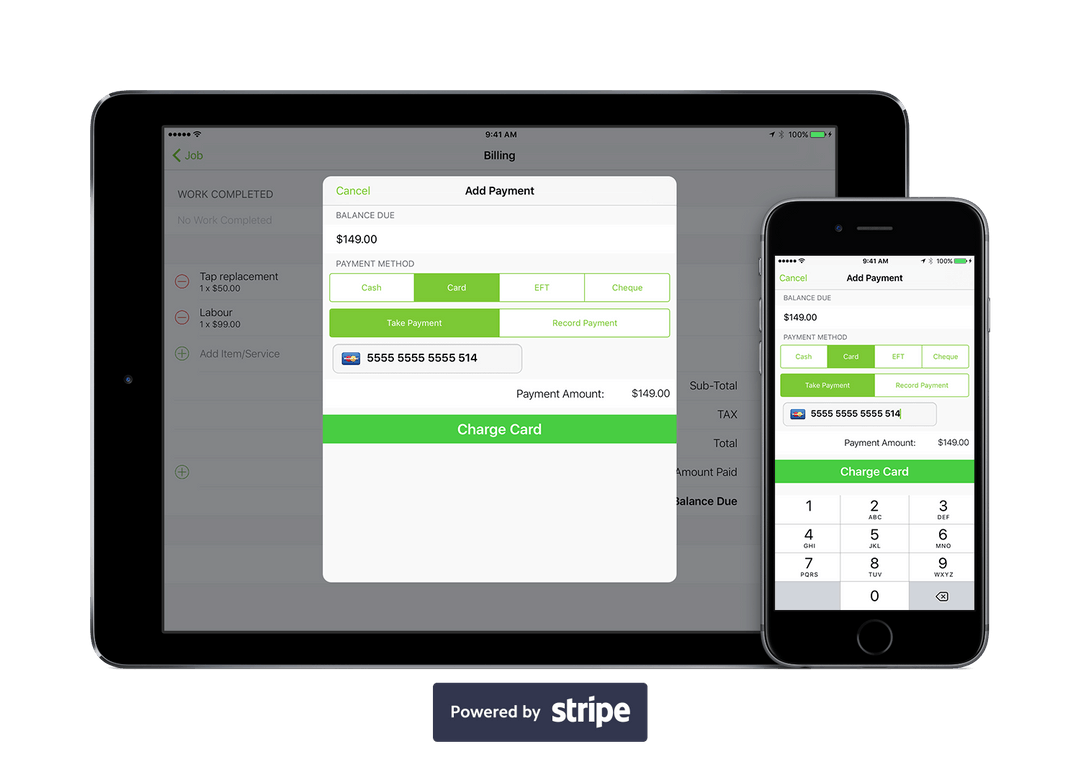

ServiceM8 makes it easy for your clients to pay you promptly. The many different payment options, including online payment, means that there is no excuse for ten-week waits that can wreak havoc on your finances.

With ServiceM8 you can take payment from your clients straight away by simply entering their credit card number or send online invoices by email and text message.

This then takes them to an online payment portal where transactions can be processed there and then.

ServiceM8 is the only business management software solution on the market to offer all the following:

- Credit card integration and processing

- Electronic payments

- Invoice management

- Partial payments and recurring billing features

Each of these features helps keep cash flow healthy and ensure you’re getting paid the correct amount exactly when you should be – which is vital to every business’ bottom line.

Do you want to learn how to use ServiceM8 to work smarter, not harder? Software Buddy provides full training to help you discover how to leverage this technology to grow your trades business. Get in touch today to arrange a consultation.